child tax credit monthly payments continue in 2022

The Additional Child Tax Credit is refundable which. New videos of beautiful cute.

Child Tax Credit Payments 2021 Who Is Eligible And How Much Are They Wsj

Instead the expanded Child Tax Credit payments expired at the end of 2021.

. Child Tax Credit Calculator for 2021 2022. The advance child tax credit payments were based on 2019 or 2020 tax returns on file. If parents opted out of some payments but not all they can expect something between 1500.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

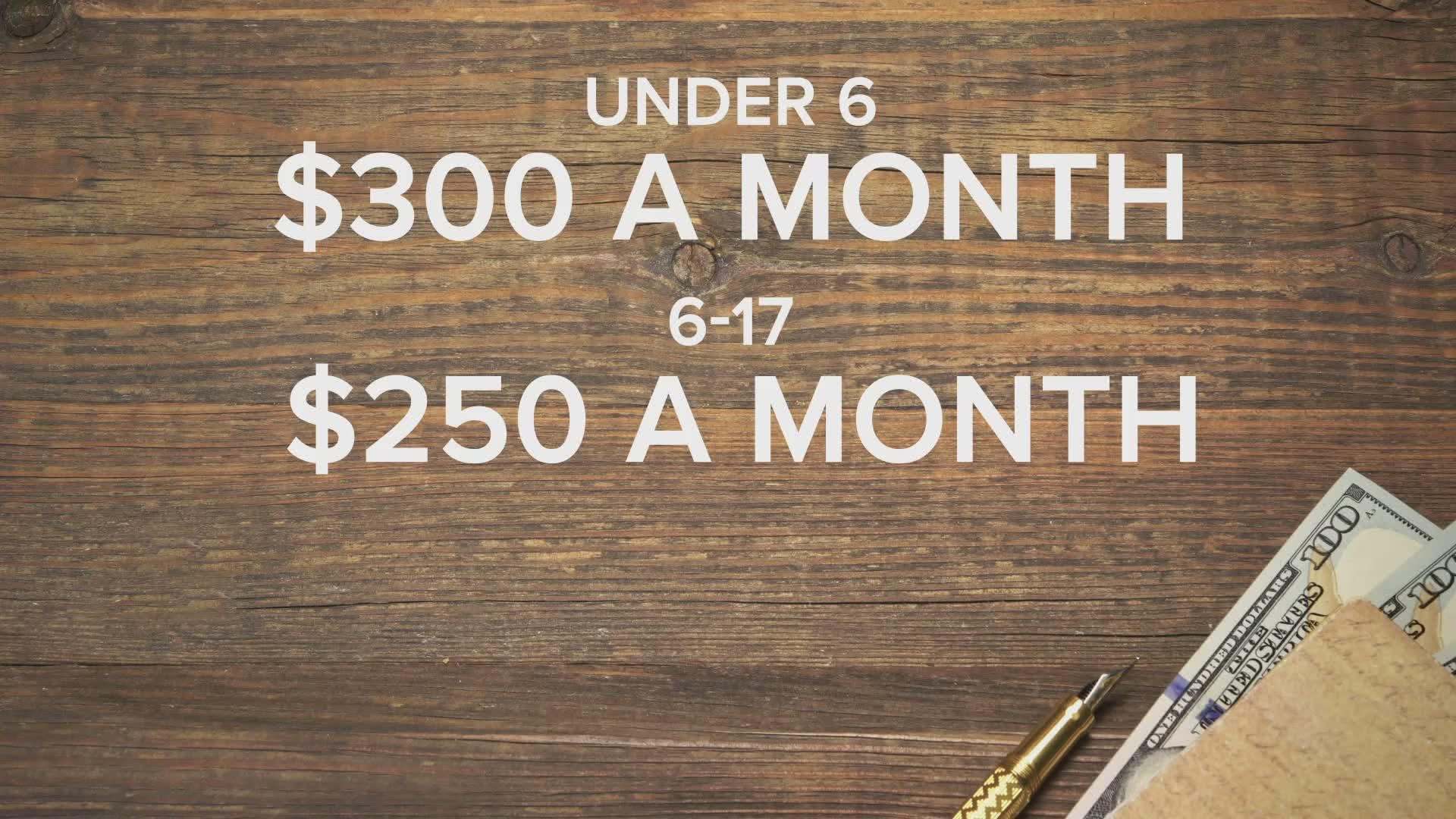

As part of the federal governments pandemic response the 2021 expansion of the Child Tax Credit increased the amount of the credit made more families eligible for the tax credit and. The existing credit of 2000 per child under age 17 was increased to 3600 per child under 6 and 3000 per child ages 6 through 17. Those returns would have information like income filing status and how many children are living with the parents.

The child tax credit is a credit that can reduce your Federal tax bill by up to 3600 for every qualifying child. Half of the enhanced sum was made. Continuing the expanded credit would have eased the effects of inflation on families.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Those who opted out of all the monthly payments can expect a 3000 or 3600.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The majority of the time it is equal to the unused portion of the Child Tax Credit up to 15 of your earned income that is more than 3000. Those returns would have information like income filing status and how many children are.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

What Families Need To Know About The Ctc In 2022 Clasp

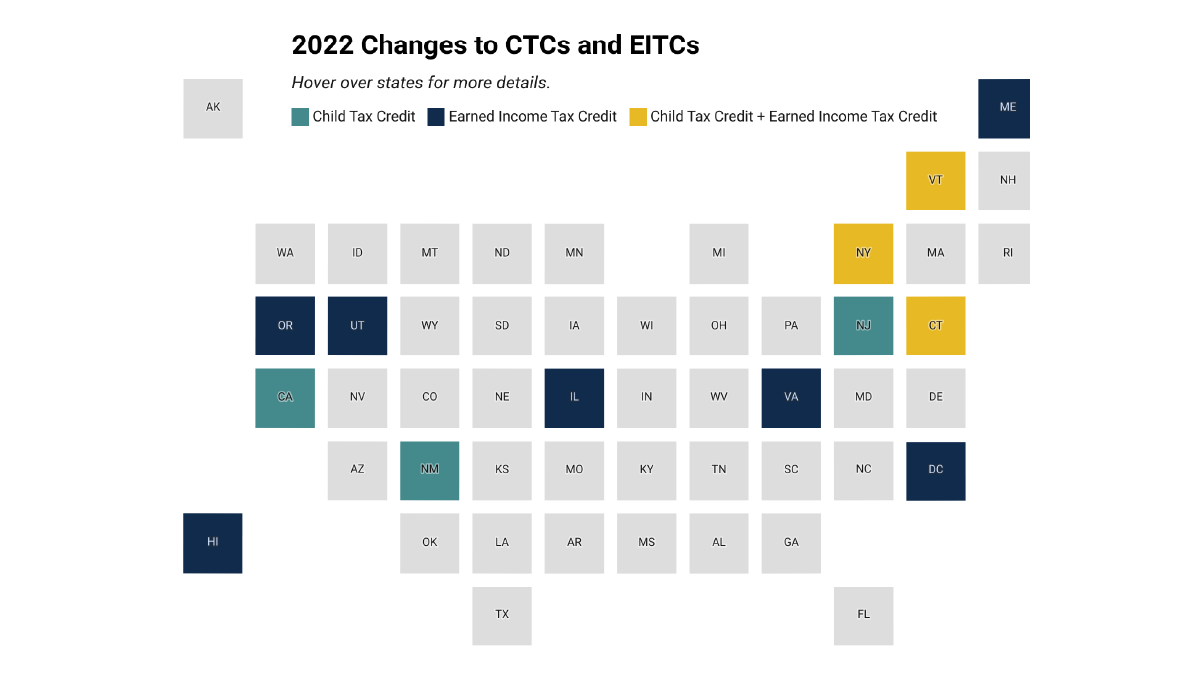

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Stimulus Update Will Child Tax Credit Monthly Payments Restart Al Com

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Child Tax Credit 2022 Huge Direct Payments Worth Up To 750 To Go Out In Weeks See If You Qualify The Us Sun

Will Monthly Child Tax Credit Payments Continue In 2022 Their Future Rests On Biden S Build Back Better Bill

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Usa Finance And Payments News Summary 23 May 2022 As Usa

Stimulus Check Update Plan Would Resume 300 Monthly Payments Al Com

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Rep Henry Cuellar On Twitter I Voted For The Child Tax Credit Because It Helps Lift Children Out Of Poverty And Keeps More Money In The Pockets Of American Families I Will

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

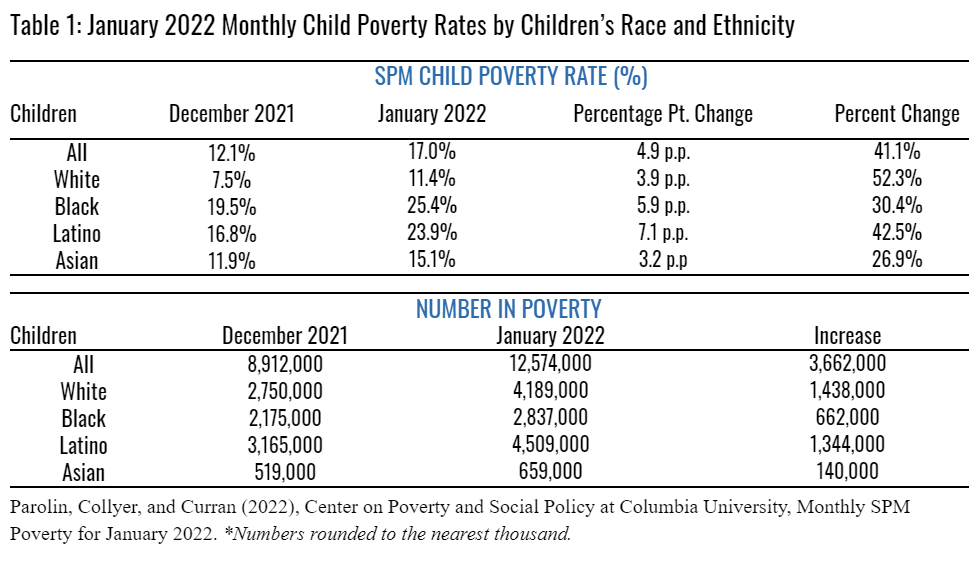

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor